Profile 2020: Economic Report on the Screen-Based Media Production Industry in Canada

Profile 2020 is published by the Canadian Media Producers Association (CMPA) in collaboration with the Department of Canadian Heritage, Telefilm Canada, the Association québécoise de la production médiatique (AQPM) and Nordicity. Profile 2020 is the 24th edition of the annual economic report prepared by the CMPA and its project partners. The complete report is available at https://cmpa.ca/profile/.

HIGHLIGHTS FROM PROFILE 2020

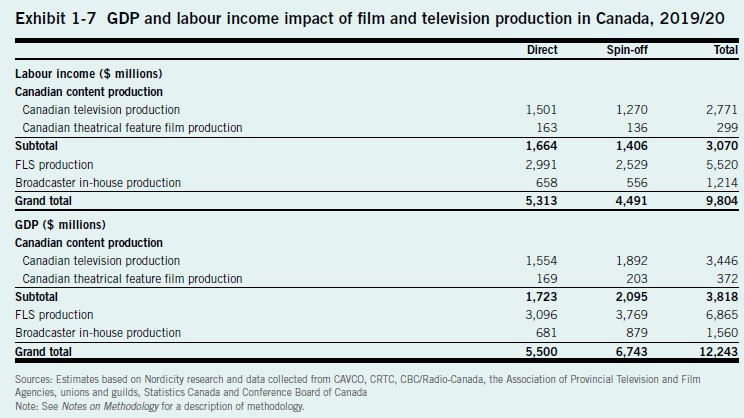

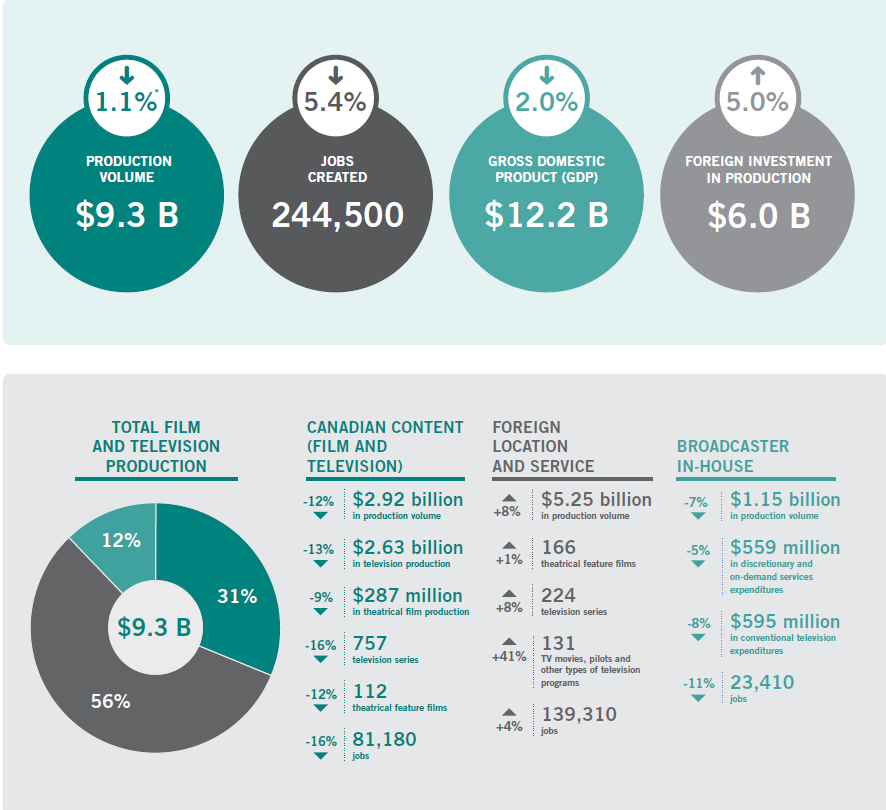

The film and television production industry in Canada consists of four key segments: The Canadian Television Production segment, Canadian Theatrical Feature Film Production, Foreign Location and Service Production (FLS), and Broadcaster In-house Production. Here is 2019-2020 At A Glance:

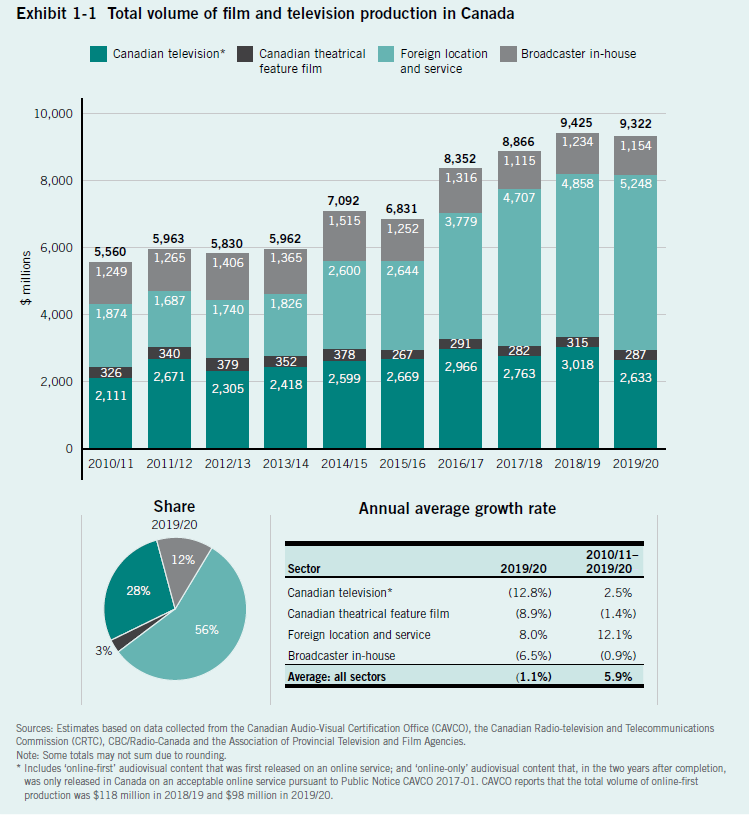

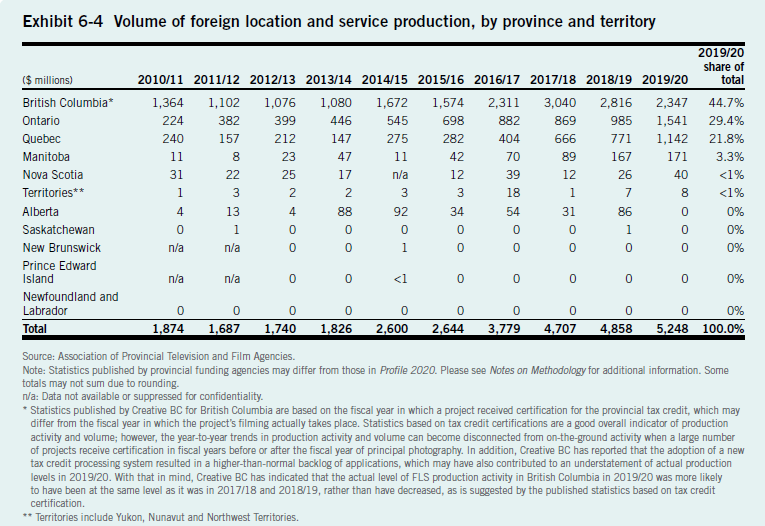

After reaching an all-time high of $9.43 billion in 2018/19, the total volume of film and television production in Canada experienced a modest 1.1% dip in 2019/20. The only segment that saw an increase in production volume was FLS production, totalling over $5 billion for the first time, and continuing its growth pattern over the last 10 years. FLS production increased by 180% between 2010/11 and 2019/20 (Exhibit 1-1). With over $2.3 billion in volume, British Columbia remained Canada’s leading province for FLS production; however, higher levels of FLS television production in Ontario and Quebec drove the segment’s overall growth (Exhibit 6-4).

Foreign Location and Service (FLS) Production in Canada

The foreign location and service (FLS) production segment is primarily comprised of films and television programs filmed in Canada mainly by foreign producers with the involvement of Canadian-based service producers. This includes the visual effects (VFX) work done by Canadian VFX studios for foreign films and television programs. For the majority of FLS projects, the copyright is held by non-Canadian producers; however, for approximately 5% to 10% of projects, the copyright is held by Canadians.

In recent years, Canada’s FLS production segment has contributed to numerous films that achieved successful global box office runs. Some recent Hollywood films that have either been shot in Canada or had their VFX work done in Canada include Operation Christmas Drop, Gretel & Hansel, To All the Boys I’ve Loved Before 3 and There’s Someone Inside Your House. Canada has also become a destination for the filming of many American television series and mini-series such as The Queen’s Gambit, The Umbrella Academy, Arrow, Titans, Riverdale, See, The Handmaid’s Tale, The Boys and Star Trek: Discovery, which have been commissioned by US networks as well as online video streaming services.

Content production by existing international subscription video on demand (SVOD) platforms such as Netflix, Amazon Prime Video, Disney+, AppleTV+, HBO Max, and Hulu helped lift FLS production in Canada to an all-time high in 2019/20. Overall, the volume of FLS production in Canada increased to a new record of $5.25 billion (Exhibit 6-1). This increase was due entirely to higher levels of television production, as FLS feature film production actually declined by $125 million.

Highlights:

- FLS was, once again, up significantly (8%) in 2019/20 fuelling increases in GDP and employment with $5.25 billion in volume.

- The total volume of FLS television series production increased by 11.7% to an all-time high of $3.06 billion, with 224 series shot in Canada (up from 208 in 2018/19).

- Television series production accounted for the other 62% of the overall increase.

- The production of pilots and other types of single-episode television programming also rose from $315 million in 2018/19 to $508 million in 2019/20, a $193 million increase that accounted for 38% of the overall increase in FLS volume in 2019/20.

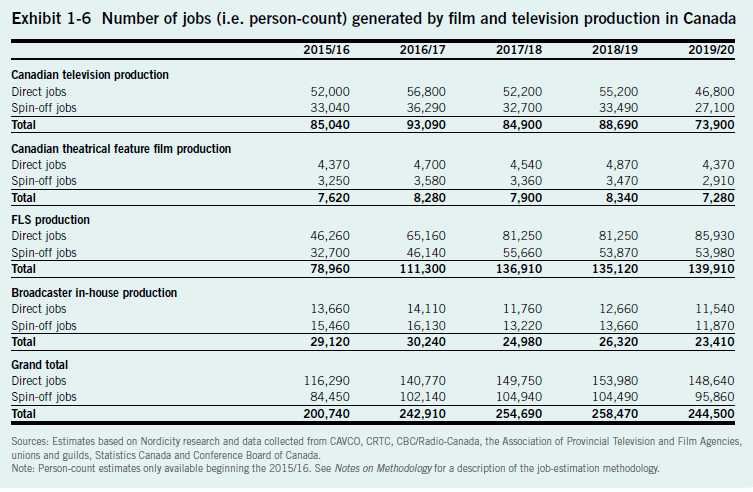

- Work in FLS production created 139,310 Canadian jobs (+4%) making up 57% of total jobs (compared to 33.2% created by Canadian content production).

- Ontario, Quebec, Nova Scotia, Manitoba and the territories were all beneficiaries of higher FLS production in 2019/20 (Exhibit 6-4). Indeed, Ontario and Quebec both saw their volumes of FLS production increase by well over $300 million in 2019/20.

- The copyright for 79% of FLS projects was held by persons or companies based in the U.S., up slightly from 78% in 2018/19.

- Over the last ten years, foreign production has been the key driver of sector growth in Canada, accounting for 90% of total growth ($3.37 billion of $3.76 billion) between 2010/11 to 2019/20.

Film and Television Production by Province

British Columbia

- Total production volume in BC reached $2.80 billion (30% of national share).

- 44.7% of Canada’s FLS production took place in BC, with volume reaching $2.35 billion (from $2.81 billion in 2018/19).

Statistics published by Creative BC and included in Profile 2020 suggest that the total volume of FLS production in British Columbia decreased by 16.7% in 2019/20 (Exhibit 6-4). According to Creative BC, the actual level of FLS production activity in British Columbia in 2019/20 was more likely to have been at the same level as it was 2017/18 and 2018/19, rather than being lower. For further information on the reporting methodology used by Creative BC and how to interpret the province’s film and TV production statistics, please see “Film and Television Tax Credit Certification/ Explanation of Reporting Methodology” at creativebc.ca.

Ontario

- Total production volume in Ontario reached $3.55 billion (38% of national share).

- 29.4% of Canada’s FLS production took place in Ontario, with volume increasing by $556 million to a record $1.54 billon due to an increase in production volume of FLS TV series (from $726 million to a record $1.21 billon) and TV movies, pilots and other single-episode programming (from $79 million to $151 million).

Quebec

- Total production volume in Quebec was $2.30 billion (25% of national share).

- Quebec benefited from higher demand for services from its VFX studios, and total FLS production rose by $371 million to $1.14 billon (21.8% of national share).

Manitoba

- Total production volume in Manitoba was $242 million (3% of national share).

- In Manitoba, FLS production was $4 million, or 2.3%, higher in 2019/20, reaching a 10-year record of $171 million.

Alberta

- Total production volume in Alberta was $220 million (2% of national share).

- Profile 2020 reports no FLS productions in Alberta (down from $86 million in 2018/19) for 2019/20.

Nova Scotia

- Total production volume in Nova Scotia was $132 million (1% of national share).

- In Nova Scotia, FLS production volume rose from $26 million in 2018/19 to $40 million in 2019/20 – growth supported in part by the province’s decision to increase the size of its Film and Television Production Incentive Fund from $20 million to $26 million in 2019/20.

Newfoundland and Labrador

- Total production volume in Newfoundland and Labrador was $17 million (<1% of national share).

- Profile 2020 reports no FLS production in Newfoundland and Labrador for 2019/20

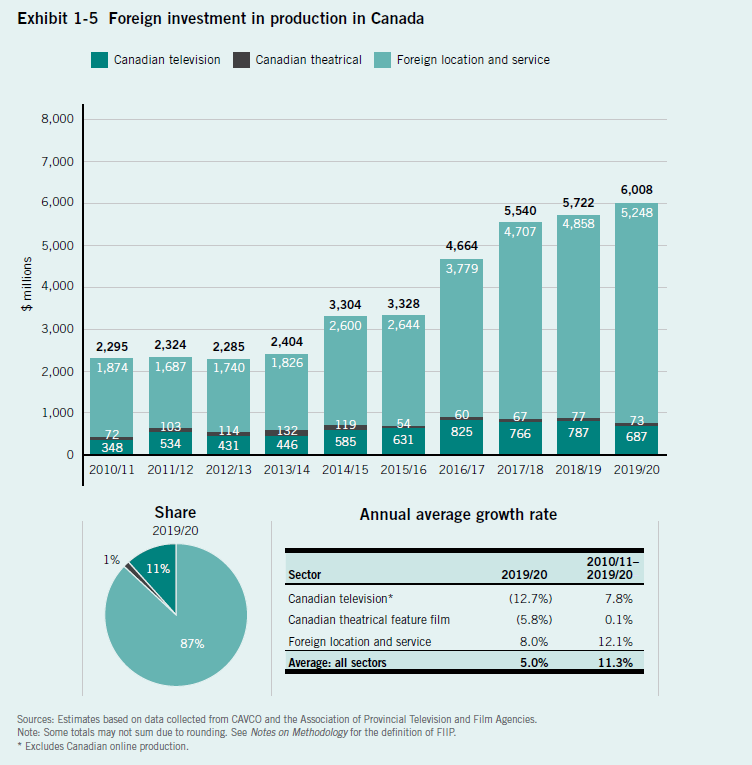

Foreign Investment in Production

Foreign investment in production (FIIP) tracks the value of international financial participation in the film and television production industry in Canada. FIIP includes foreign presales and distribution advances for all projects certified by CAVCO; estimates of presales and distribution advances for non-CAVCO-certified productions; and the total value of foreign location and service (FLS) production in Canada.

FIIP as opposed to just exports better reflects the nature of film and television production in Canada. It acknowledges that film and television productions are intangible products and portions of the copyright can be exported to foreign countries. It also accounts for the budgets of productions shot in Canada, even when the copyright is held by a foreign entity.[1]

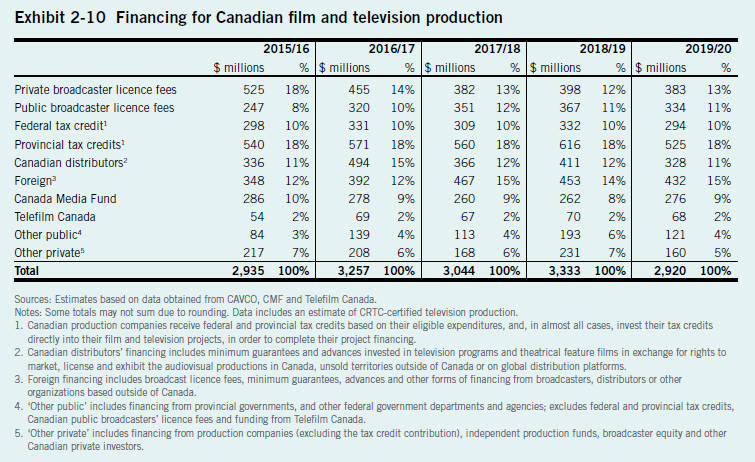

Foreign financing of Canadian production includes broadcast licence fees, minimum guarantees, advances and other forms of financing from broadcasters, distributors or other organizations based outside of Canada. In recent years, increased demand for content around the globe has been a key driver of investment in Canadian production. This financing most readily takes the form of “pre-sales” of distribution and broadcast rights to international buyers.

Highlights:

- The total value of foreign investment in production in Canada increased by 5% to $6 billion (including $5.25 billion in FLS production).

- Between 2010/11 and 2018/19, total foreign investment in production (FIIP) of Canadian content more than doubled – from $421 million to $864 million (Exhibit 1-5). In 2019/20, however, it declined by $104 million. Despite this decrease, foreign investment still accounted for 15% of the total financing for Canadian content production (Exhibit 2-10).

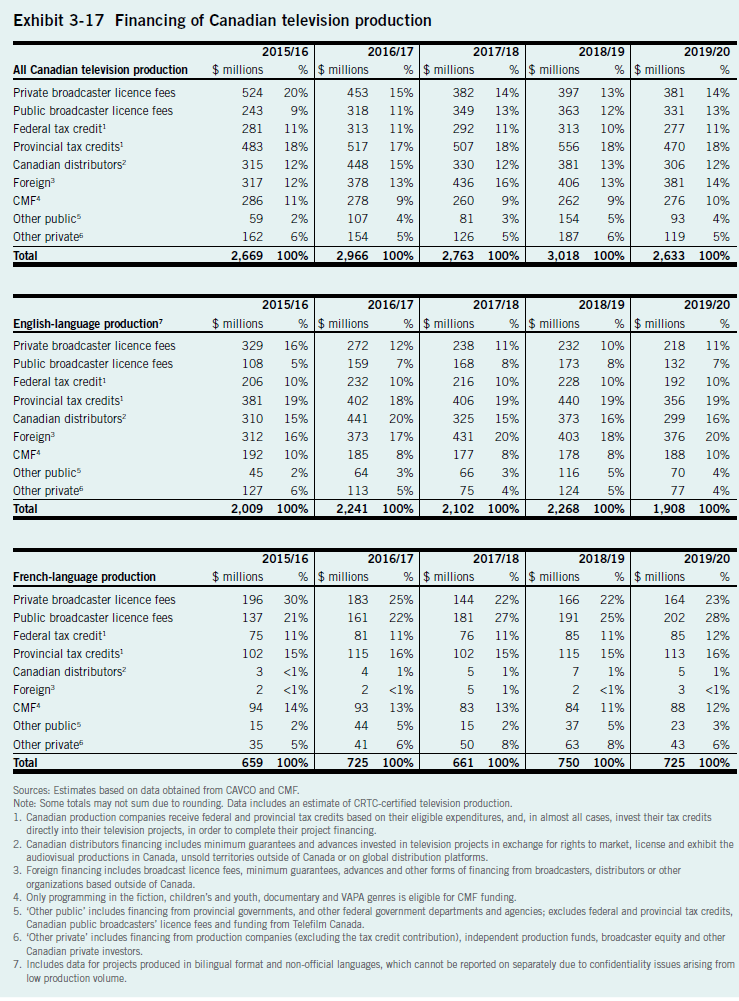

- Foreign financing remains the single largest source for Canadian television production for English-language productions (20%) and is second only to provincial tax credits for all Canadian film and television production.

[1] The data used to estimate FIIP only includes the financing of the Canadian budget of treaty coproductions. As a result, the foreign budgets for treaty coproductions do not directly contribute to FIIP. Treaty coproductions contribute only to FIIP if the financing of the Canadian budget includes a foreign presale or distribution advance.

Key Charts