Profile 2022: Economic Report on the Screen-Based Media Production Industry in Canada

HIGHLIGHTS FROM PROFILE 2022

Profile 2022 is published by the Canadian Media Producers Association (CMPA) in collaboration with the Department of Canadian Heritage, Telefilm Canada, the Association québécoise de la production médiatique (AQPM) and Nordicity. Profile 2022 is the 26th edition of the annual economic report prepared by the CMPA and its project partners. Profile 2022 provides an analysis of economic activity in Canada’s screen-based media production industry during the period of April 1, 2021 to March 31, 2022. It also provides comprehensive reviews of the historical trends in production activity between the fiscal years of 2012/13 and 2021/22. The complete report is available at https://cmpa.ca/profile/.

TOTAL FILM AND TELEVISION PRODUCTION IN CANADA

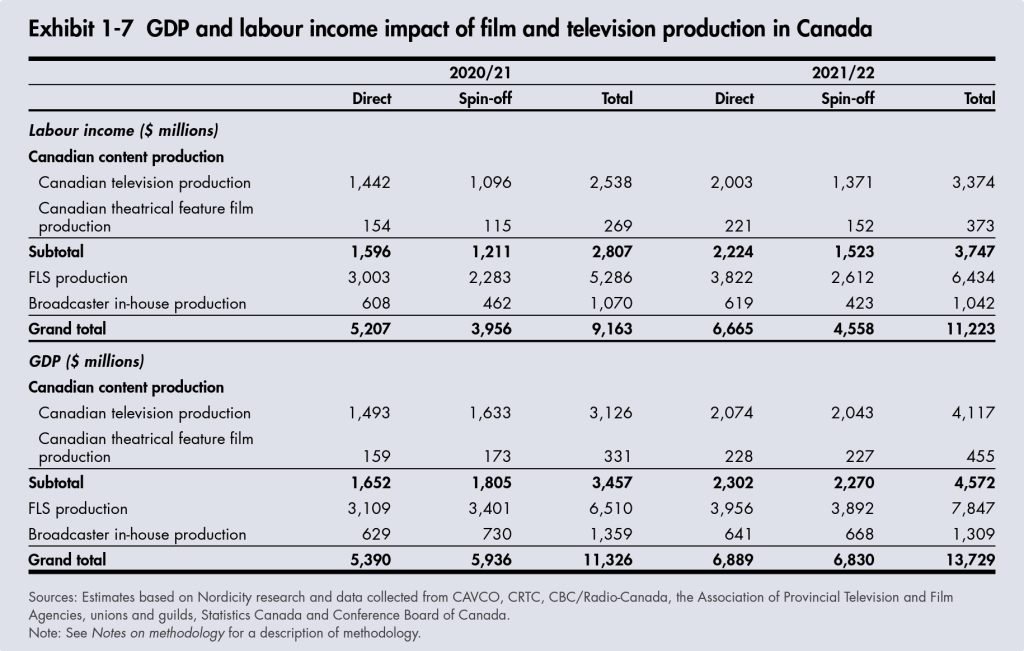

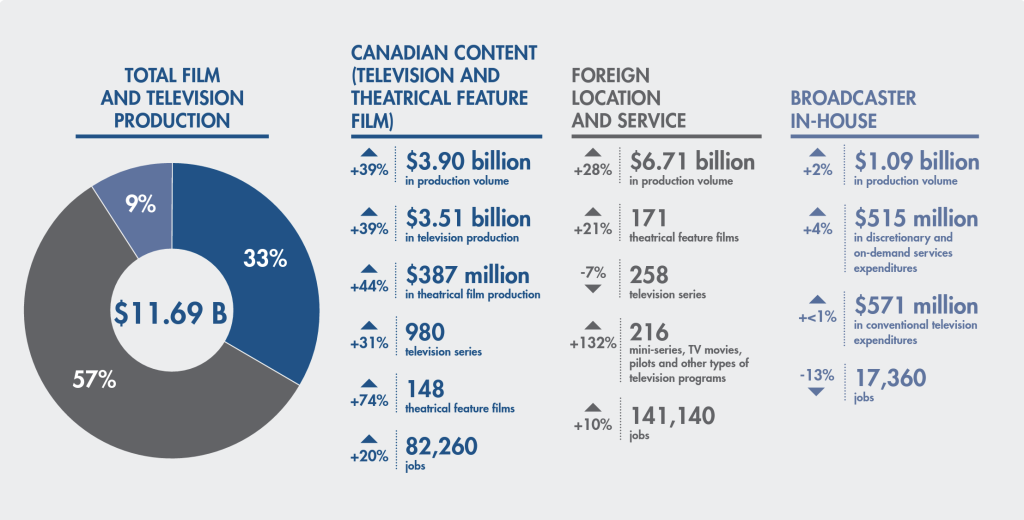

The film and television production industry in Canada consists of four key segments: The Canadian Television Production segment, Canadian Theatrical Feature Film Production, Foreign Location and Service Production (FLS), and Broadcaster In-house Production. Here are the topline figures for 2020-2021 at a glance:

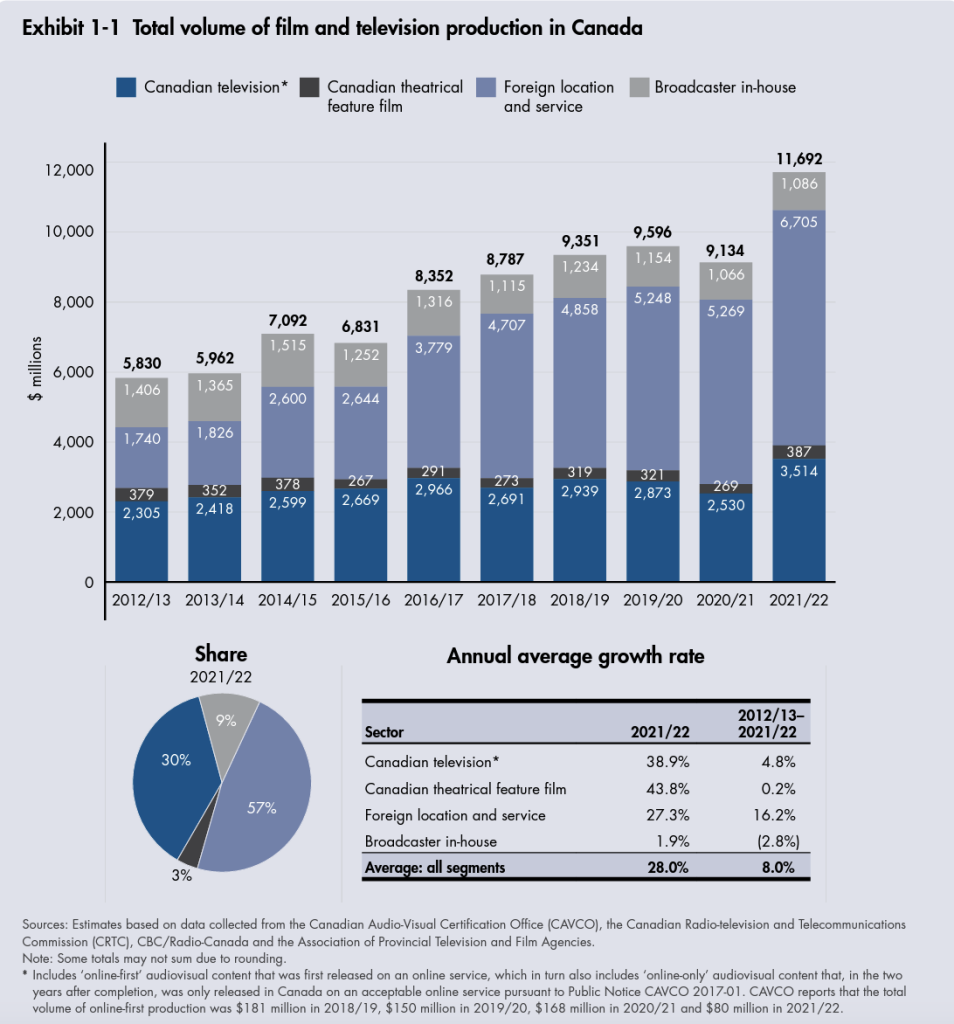

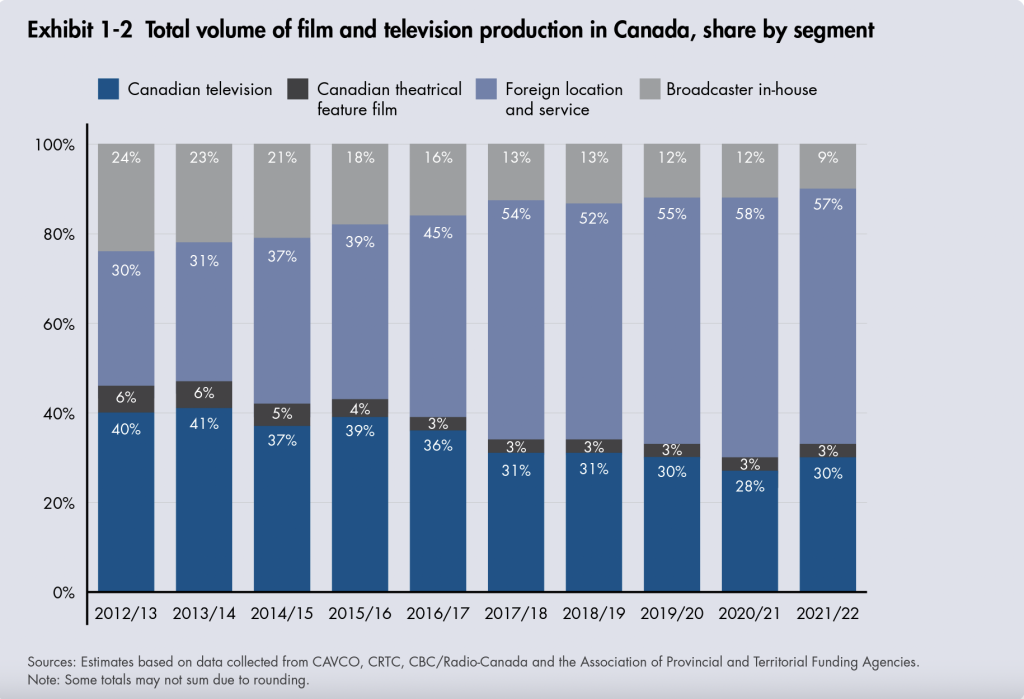

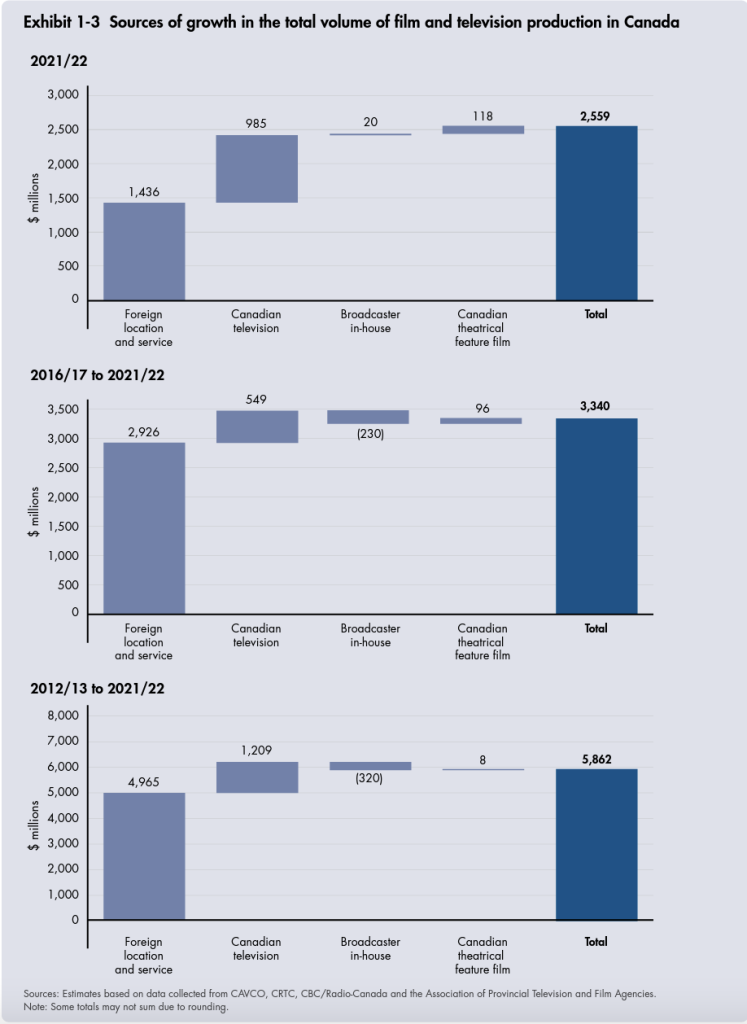

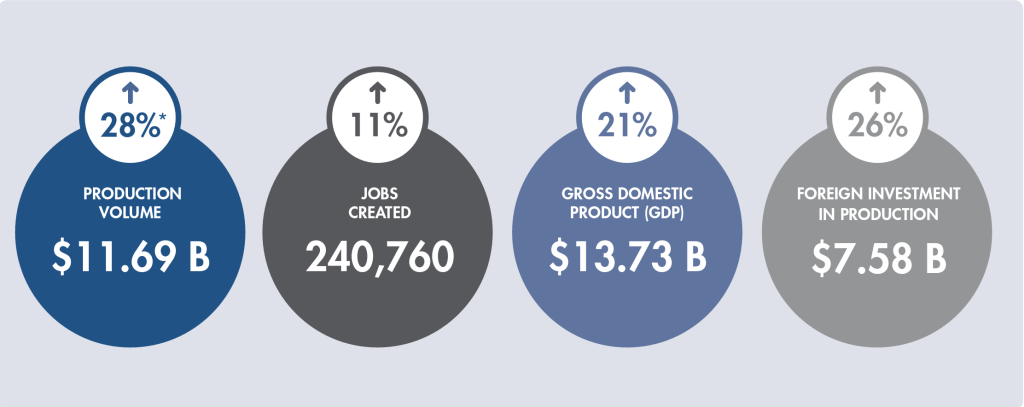

In almost every way, 2021/22 was a record year. Total production volume leapt by an unprecedented amount, reaching an all-time high of $11.69 billion. The industry added over $2.56 billion in production spending, pushing it 21.8% higher than the previous pre-pandemic high of $9.60 billion in 2019/20.

Every segment of the Canada’s film and television production industry contributed to this growth, although the biggest contributions came from foreign location and service (FLS) production, increasing 27.3% to $6.71 billion, and Canadian television production, increasing 38.9% to $3.51 billion. Coming out of the COVID-19 pandemic, the industry reversed recent trends and experienced a robust rebound in production activity.

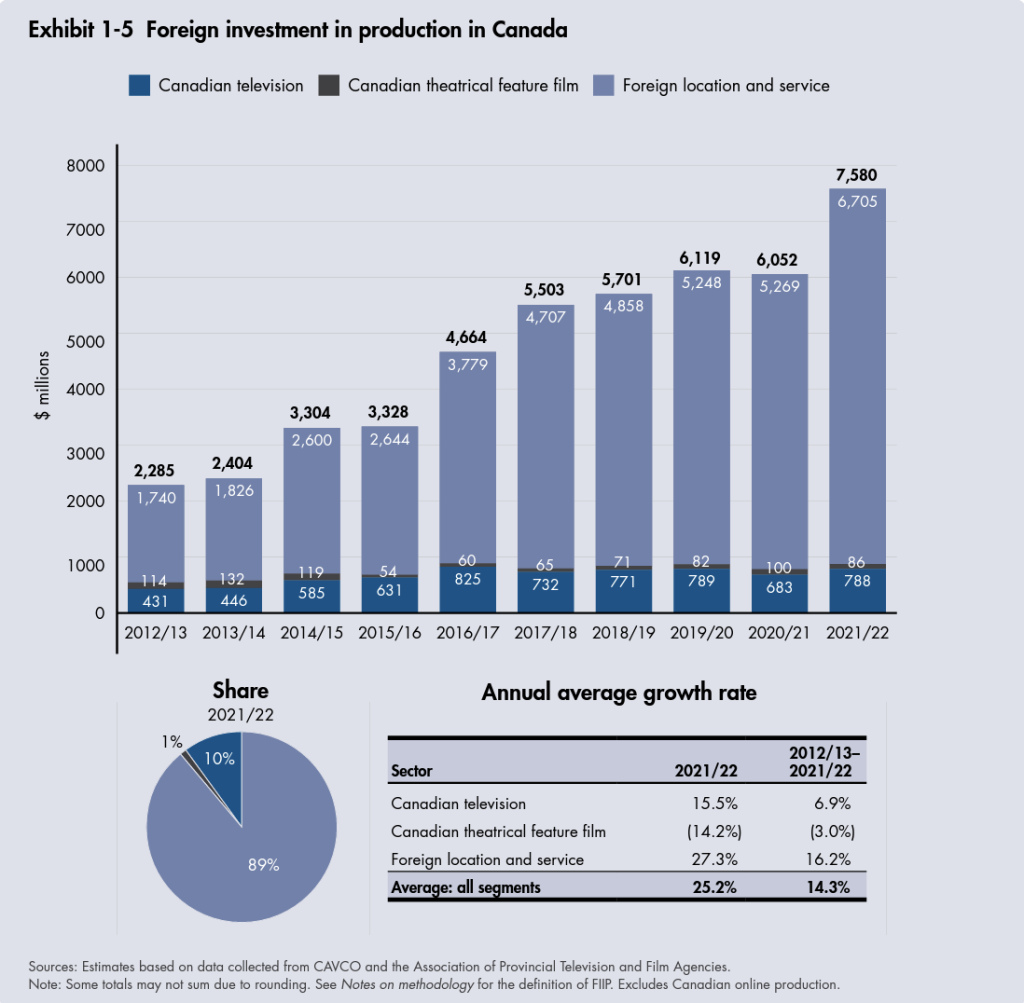

FOREIGN INVESTMENT IN PRODUCTION

Foreign investment in production (FIIP) tracks the value of international financial participation in the film and television production industry in Canada. It includes foreign presales and distribution advances for all projects certified by CAVCO, estimates of foreign presales and distribution advances for non-CAVCO-certified productions, and the total value of FLS production in Canada.

FIIP excludes the amount of revenue earned from the distribution of completed Canadian films and television programs to foreign broadcasters and distributors. However, data published by Statistics Canada (and found in Section 8) indicates that these sales of completed content generated $100 million in 2021.

Highlights:

- The value of foreign investment in production (FIIP) in Canada increased by 25.2% to $7.58 billion, including:

- $6.71 billion from foreign location and service (FLS) production, an increase of 27.3%

- $875 million in financing (through various models) for Canadian content production

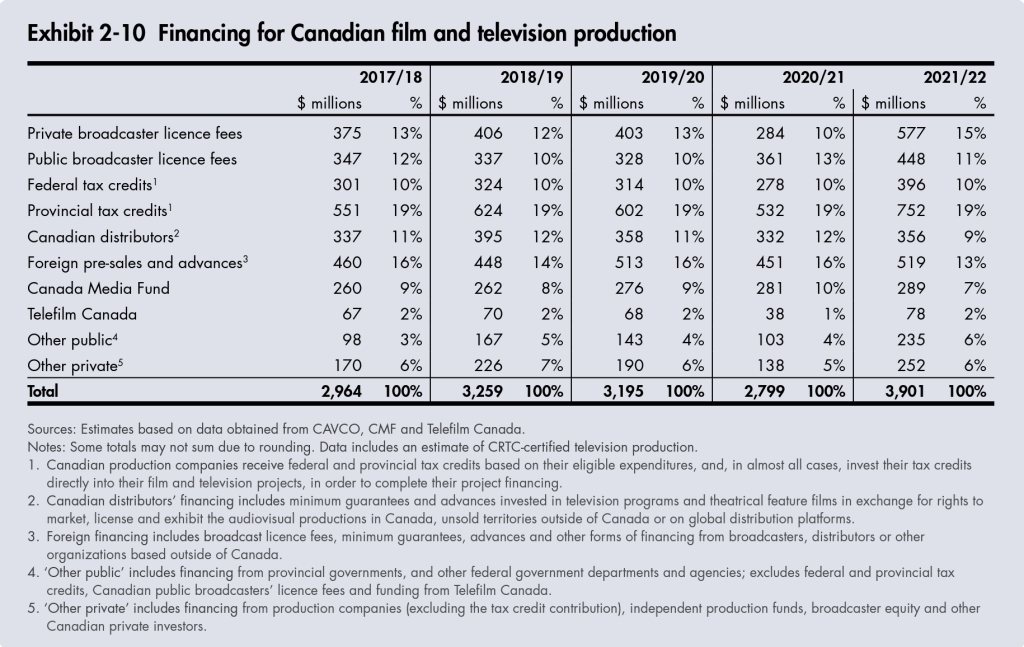

- Through various financing models, global studios & streamers are expanding the availability of Canadian-owned content, generating new audiences, revenues and discoverability for Canadian creators and producers of that content.

- Global studios and streamers account for 13% of total financing for Canadian-owned content production – making them one of the largest sources of financing. By comparison, the Canadian Media Fund accounts for 7% and Telefilm accounts for 2%.

FOREIGN LOCATION AND SERVICE (FLS) PRODUCTION IN CANADA

The foreign location and service (FLS) production segment is primarily comprised of films and television programs filmed in Canada mainly by foreign producers with the involvement of Canadian-based service producers. This includes the visual effects (VFX) work done by Canadian VFX studios for foreign films and television programs. For the vast majority of FLS projects, the copyright is held by non-Canadian producers.

In recent years, Canada’s FLS production segment has contributed to numerous films that achieved successful global box office runs. Some recent Hollywood films that have either been shot in Canada or had their VFX work done in Canada include Peter Pan & Wendy, American Dreamer, and Shang Chi and the Legends of the Ten Rings.

Canada has also become a destination for the filming of many television series commissioned by US networks or subscription video on demand (SVOD) services. Some recent series include The Good Doctor, The Flash and Peacemaker.

After remaining resilient during the COVID-19 pandemic, Canada’ FLS production segment experienced another breakout year of growth. This tremendous growth was fuelled by a period of ‘catch-up’ whereby projects initially slated to start filming in 2020 or 2021 finally went into production. The growth was also supported by the continued strong global demand for original content, particularly from subscription video-on-demand (SVOD) services, such as Netflix, Amazon Prime Video, Disney+ and AppleTV+.

Highlights:

- The total volume of FLS production in Canada increased by 27.3% to an all-time high of $6.71 billion (57% of total production volume)

- FLS feature film production increased by 19.8% to $1.66 billion.

- FLS television series production decreased by 4.1% to $3.31 billion.

- Other FLS television production increased four-fold to $1.74 billion.

- FLS production accounted for 141,140 jobs (or 59% of total jobs) and contributed $6.4 billion in labour income

- The total number of FLS productions increased from 511 to an all-time high of 645.

- The number of FLS feature films shot in Canada increased from 141 to 171.

- The number of FLS television series shot in Canada decreased from 277 to 258.

- The number of other FLS television1 projects increased by 132.2%, from 93 to 216.

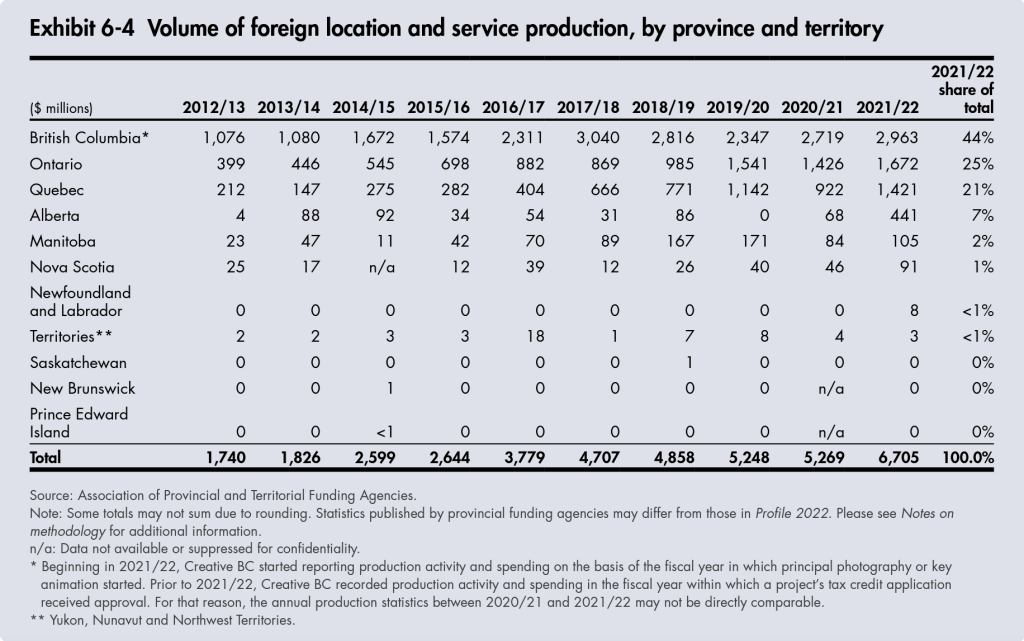

FILM AND TELEVISION PRODUCTION BY PROVINCE

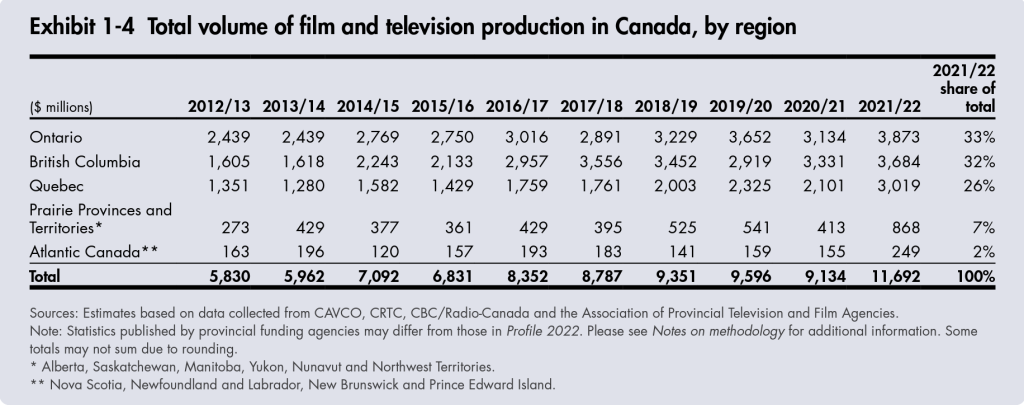

The growth in FLS production in 2021/22 was shared across all provinces that hosted FLS production in 2020/21. Indeed, some provinces experienced remarkable gains that even moved them well past the levels they experienced prior to the COVID-19 pandemic.

BRITISH COLUMBIA

- Total Volume: $3.68 billion (32% total share)

- FLS Volume: $2.96 billion, a 9% increase (44% total share)

- British Columbia was the Canadian province with the highest level of FLS in 2021/22.

ONTARIO

- Total Volume: $3.873 billion (33% total share)

- FLS Volume: new record of $1.67 billion, a 17.3% increase (25% total share)

- According to Ontario Creates, all of Ontario’s gains in FLS production were in television series category, as both other television and feature film production declined.

QUEBEC

- Total Volume: $3.02 billion (26% total share)

- FLS Volume: all-time high of $1.42 billion, a 54.1% increase (21% total share)

- Approximately 70% of the FLS increase was in the feature film category.

ALBERTA

- FLS Volume: a record $441 million, more-than-quintupled, jumping from $68 million in 2020/21 (7% total share)

- Looking back to 2012/13, Alberta’s volume of FLS production was never higher than $92 million.

- The vast majority of the growth in 2021/22 was concentrated in the production of television series and mini-series, but there were also substantial gains in other-television and feature film production.

- Increased funding for Alberta’s film and television tax credit combined with the removal of the per-project tax credit cap has helped attract substantial FLS production to Alberta.

MANITOBA

- FLS Volume: $105 million, an increase of 25% (2% total share)

- According to Manitoba Film and Music, all of Manitoba’s gains were in the feature film category.

NOVA SCOTIA

- FLS Volume: $91 million, a new 10-year high for the province and almost double the previous year. (1% total share)

- Approximately 90% of the FLS growth in 2021/22 was in the television series category.

NEWFOUNDLAND AND LABRADOR

- FLS Volume: $8 million (<1% total share)

- Filming of Disney’s Peter Pan & Wendy allowed the province to record its first FLS production during the past decade.

KEY CHARTS